I smoke cigarettes…

Pretty stupid for a guy inspiring personal change, right? Believe me, I know!

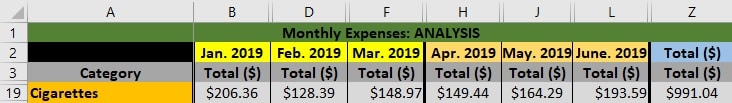

I also keep meticulous records of my personal expenses with daily inputs into an elaborate Excel spreadsheet I created for myself 20 months ago. Pretty nerdy, right? Believe me, I know that, too!

Regardless, as a result I have very accurate records of my cigarette expenses.

For the first half of 2019 I have spent precisely $991.04 on cigarettes:

If you prorate this to an entire year, I project to spend $1982.08 in 2019.

That’s an average of $165.17 per month.

What does this mean for my future financial wellbeing?

The “facts” so far:

- I am 33 years old.

- Despite smoking, and according to Blueprint Income, my life expectancy is 81 years old.

- In theory, I have 48 more years to live.

- Let’s do some simple math:

(48 years) x ($1982.08 per year) = $95,139.84 personally spent on cigarettes between now and my death

BEFORE YOU OBJECT: For the sake of simplicity, I am not considering the rising costs of cigarettes due to inflation nor the time value of money in any way, shape or form. Nor does my calculation take into consideration the health risks and associated expenses caused by smoking cigarettes. This exercise is purely financial, and based solely on my personal cost of buying cigarettes for the first six months of 2019. If you want to dig deeper, please do. Fo me, this exercise is sufficient to make my point that smoking makes you less wealthy, and by a large amount!

Taxes

“A dollar saved is worth more than a dollar earned.”

– I learned this from my dad.

$95,139.84 is quite a bit of money. Here is the worst part: this is money spent, not money earned. To recoup this $95,139.84 I would need to earn, assuming a 25% tax rate for simplicity, $126,853.12. This just got worse!

At my historical income level, it would take me 5-6 years of work just to pay off my cigarette expenses until I die. Very stupid!

But That’s Not $1,049,178!

Well done, Sherlock!

There is another component to consider:

Opportunity Cost

The choice to smoke comes with an opportunity cost. Instead of spending this money on cigarettes, I could have done any number of things with it. After fantasizing about what I could do with $95,139.84 today, I quickly discovered that I could buy a library!!! Just sayin…

In all seriousness, what If I had invested this money instead?!?

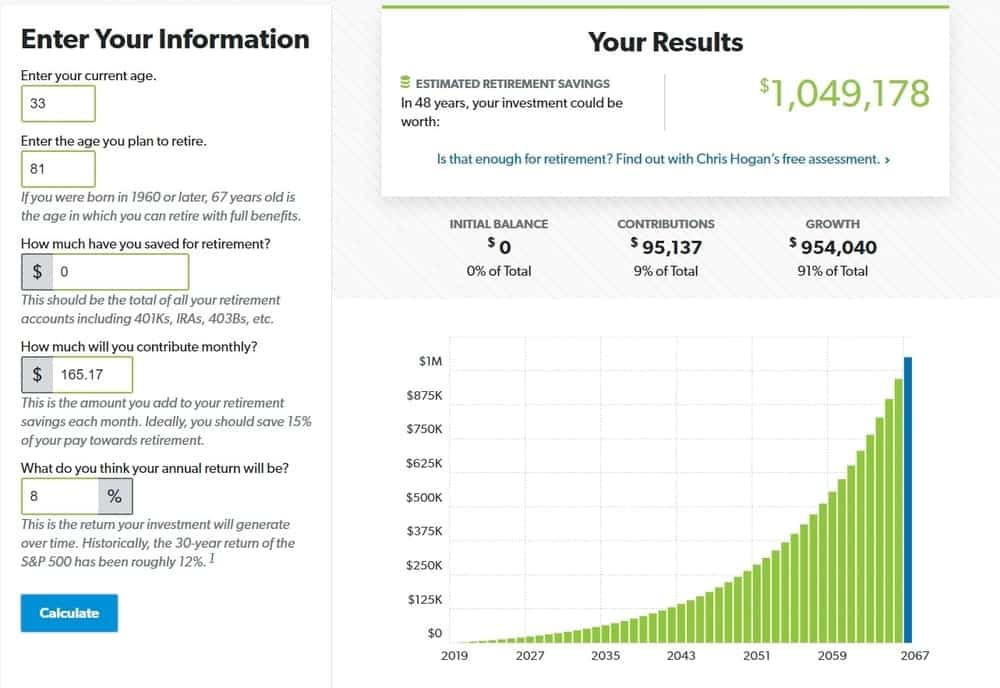

To calculate this, I used a FREE investment calculator offered by Dave Ramsey. I am a big Dave Ramsey fan, and I especially like this calculator because you can calculate monthly investment contributions, not only annual contributions.

How to Calculate

Here are the steps to calculate the opportunity cost of smoking cigarettes:

- Open a low-fee index fund. I recommend and use Vanguard.

- Don’t buy or smoke cigarettes.

- Instead, invest that money monthly. For me, it’s $165.17 per month.

- Do this until you die. For me, let’s assume for 48 more years.

- Assume an 8% average annual interest rate. Experiment with this.

- Calculate…

The Results

Here is what I discovered:

- I would personally contribute: $95,137

- I would earn over time: $954,040

$95,137 (contribution) + $954,040 (growth) = $1,049,178

My opportunity cost if I continue to smoke cigarettes.

And There You Have It…

Every cigarette I smoke from this day forward until the day I die is a $1,000,000 decision. Not smart… very not smart!

But Wait! There’s More…

I have smoked for about 9 of the last 14 years, too! Just for a goof, let’s add 9 years onto this calculation. Using the same process, the results are:

(All my previous smoking) + (continuing to smoke) = $2,124,043

A Reflection

If I continue to smoke until the day I die, I will have wasted over a million dollars! This is money I could give to my future family, worthwhile charities, or use to pay for half of my future funeral expenses (inflation, right?!?).

But no… instead, I give it all to big tobacco. Stupid. Soooo stupid!

Full disclosure: I just had another cigarette. That was a $1,000,000 decision… so stupid…

Want To Quit Smoking?

(Disclaimer: The rest of this blog post contains affiliate links.)

If you want to quit smoking cigarettes, I suggest consulting your family doctor. The best I can do for you is share my experience, this little calculation, and to recommend this book which helped me immensely when I “successfully” quit for over four years back in 2012:

Allen Carr’s Easy Way to Stop Smoking by Allen Carr

I do believe that it is the best resource available for anyone wanting to become a non-smoker. I have read it in the past and “successfully” quit for over four years. All it took was one cigarette in a moment of drunken weakness to get me totally addicted to them again. I have repurchased the book. Expect updates on this in the near future!

Want to Invest?

As far as investing goes, entire books have been written on this subject. I have read many of them, and I strongly suggest these resources:

- Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School – Andrew Hallam

- The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns – John C. Bogle

- Common Sense on Mutual Funds – John C. Bogle

I personally have a Vanguard Total Stock Market Index Fund. I love the company, everything they stand for, and the man who started it all, John C. Bogle (1929-2019).

WARNING: I am not a fiduciary financial advisor. I recommend Vanguard not as an affiliate; rather, because I use their services and am happy with the results. Realize that all investing is subject to risk, and you may lose part, or all, of the money that you invest. Still, it’s better than smoking!

Next Steps:

- If you smoke cigarettes, quit and invest that money.

- If you already invest, save and invest more.

- Leave a comment below : )